Due to a little-noticed provision in the new highway appropriations bill signed into law on July 31 – the Surface Transportation and Veterans Health Care Choice Improvement Act of 2015 – the deadline for filing an FBAR (Report of Financial Bank and Financial Accounts) has been moved up from June 30 to April 15. But taxpayers who are required to file FBARs can now get an automatic six-month filing extension – just like they can with 1040s.

The changes make sense because it lines up FBAR filings with the April 15th due date for filing individual returns. Oversight of FBARs rests with the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of Treasury.

A client must file an FBAR with the IRS if the aggregate value of assets in foreign bank accounts exceeded $10,000 at anytime during the prior year. This rule was imposed to deter taxpayers from hiding assets in offshore accounts and evading their tax liability. It applies to banking and financial accounts in all geographical areas outside the U.S., Puerto Rico, the Northern Mariana Islands and the territories and possessions of the U.S. (including Guam, American Samoa and the Virgin Islands).

Make no mistake about it; the penalties for failing to file an FBAR are severe. If the violation is “willful,” the tax evader can be hit with a fine equal to the greater of $100,000 or 50% of the balance in the account for each violation. Even steeper penalties may be assessed for acts of fraud or providing false information. And the damages aren’t limited to your wallet: You might also be sentenced to a prison term of up to five years (ten years for an obstruction of justice).

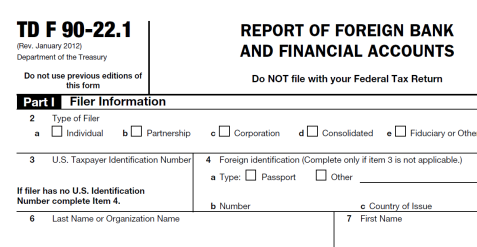

FBARs now must be reported electronically on FinCEN Form 114 at bsaefiling.fincen.treas.gov. The form asks you to include a statement explain the reasons for a late filing.

The IRS generally has six years to hunt down taxpayers who have failed to file FBARs on time. Confessing to past sins can be a sensitive issue for clients, but they may be able to take advantage of a special amnesty program, the Offshore Voluntary Disclosure Program (OVDP). The IRS recently streamlined the procedures for participating in the OVDP and added other modifications to encourage more taxpayers to use it.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, Taxes